nd sales tax calculator

Youll then get results that can help provide you a better idea of what to expect. The latest sales tax rate for Fargo ND.

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

Gross receipts tax is applied to sales of.

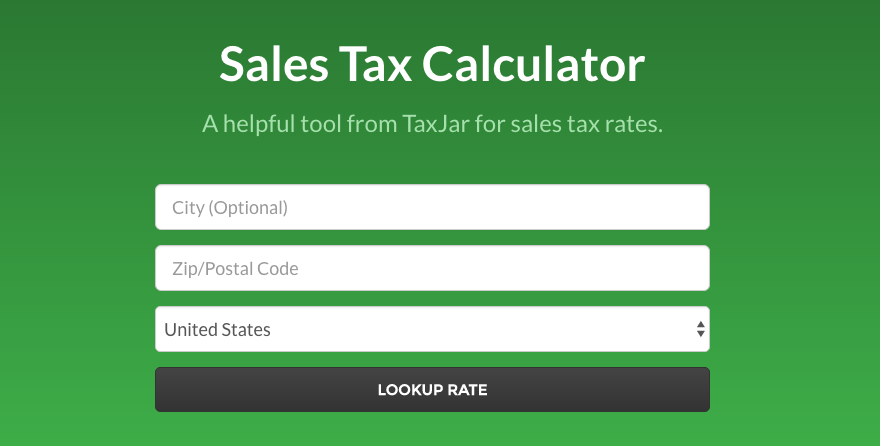

. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Before Tax Price Sales Tax Rate After Tax Price Related VAT Calculator What is Sales Tax. Thursday June 23 2022 - 0900 am.

Apportioned vehicles can not be calculated by this system. The sales tax rate does not vary based on zip code. A full list of locations can be found below.

North Dakota sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Enter an amount into the calculator above to find out how what kind of sales tax youll see in Fairfield North Dakota. Youll then get results that can help provide you a better idea of what to expect.

5 Average Sales Tax Summary. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Taxable sales and purchases for January February and March of 2022 were 47 billion.

Purchase Location ZIP Code -or-. Local tax rates in North Dakota range from 0 to 35 making the sales tax range in North Dakota 5 to 85. North Dakota ND Sales Tax Rates by City The state sales tax rate in North Dakota is 5000.

Multiply the price of your item or service by the tax rate. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to North Dakota local counties cities and special taxation districts. North Dakota Sales Tax.

ND Rates Sales Tax Calculator Sales Tax Table. North Dakota state sales tax rate range 5-85 Base state sales tax rate 5 Local rate range 0-35 Total rate range 5-85 Due to varying local sales tax rates we strongly recommend using our calculator below for the most accurate rates. Download state rate tables Get a free download of average rates by ZIP code for each state you select.

With local taxes the total sales tax rate is between 5000 and 8500. Find list price and tax percentage Divide tax percentage by 100 to. Your household income location filing status and number of personal exemptions.

Sales Tax Calculator Calculate Before Tax Amount 000 Sales Tax 000 Plus Tax Amount 000 Minus Tax Amount 000 Enter an amount into the calculator above to find out how what kind of sales tax youll see in Cooperstown North Dakota. You can use our North Dakota Sales Tax Calculator to look up sales tax rates in North Dakota by address zip code. Find your North Dakota combined state and local tax rate.

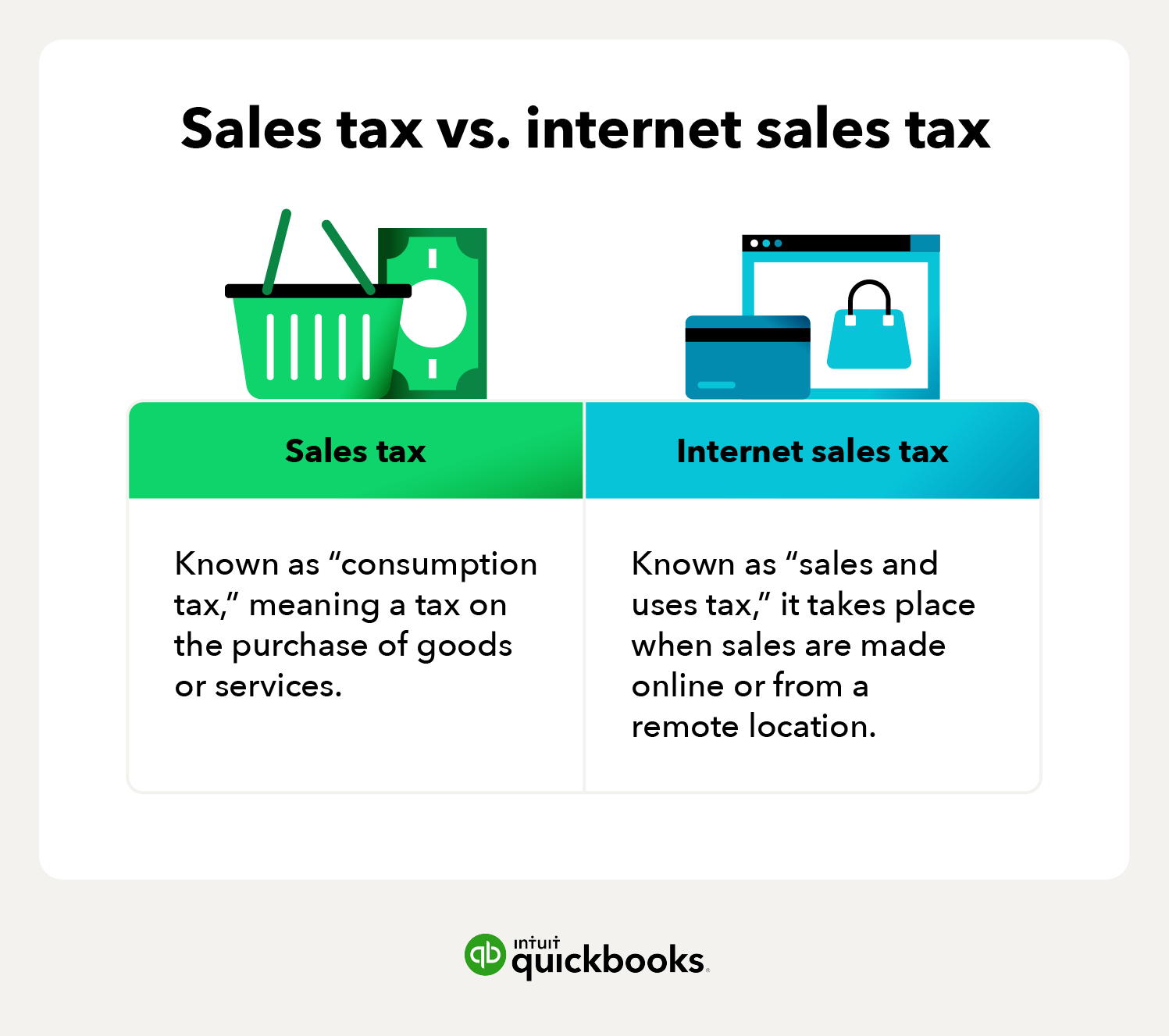

This rate includes any state county city and local sales taxes. If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction. Sales Tax Calculator Calculate Before Tax Amount 000 Sales Tax 000 Plus Tax Amount 000 Minus Tax Amount 000 Enter an amount into the calculator above to find out how what kind of sales tax youll see in Parshall North Dakota. North Dakota Sales Tax Calculator and Economy 577 Average Sales Tax For North Dakota Sales Tax Calculator Calculate CALCULATING Before Tax Amount000 Sales Tax000 Plus Tax Amount000 Minus Tax Amount000 If youre selling an item and want to receive 000after taxes youll need to sell for 000.

Sales Tax Calculator Calculate CALCULATING Before Tax Amount000 Sales Tax000 Plus Tax Amount000 Minus Tax Amount000 If youre selling an item and want to receive 000after taxes youll need to sell for 000. Alcohol at 7 New farm machinery used exclusively for agriculture production at 3 New mobile homes at 3. Sales Tax Calculator Calculate CALCULATING Before Tax Amount000 Sales Tax000 Plus Tax Amount000 Minus Tax Amount000 If youre selling an item and want to receive 000after taxes youll need to sell for 000.

Fee Calculation This system will provide online motor vehicle fee calculations to determine registration fees and credits as well as tax and other fees. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to North Dakota local counties cities and special taxation districts. The North Dakota sales tax rate is 5.

State Sales Tax The North Dakota sales tax rate is 5 for most retail sales. All fees will be recalculated by the Motor Vehicle Division and are subject to change. Sales Tax Breakdown For Larimore North Dakota.

To find the total sales tax rate combine the North Dakota state sales tax rate of 5 and look up the local sales tax rate with TaxJars Sales Tax Calculator. 54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction.

Select the North Dakota city from the list of popular cities below to see its current sales tax rate. Then use this number in the multiplication process. Enter an amount into the calculator above to find out how what kind of sales tax youll see in Wishek North Dakota.

65 Average Sales Tax. Before-tax price sale tax rate and final or after-tax price. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

2020 rates included for use while preparing your income tax deduction. North Dakota has recent rate changes Thu Jul 01 2021. Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the first quarter of 2022 are up 132 compared to the same timeframe in 2021.

The timezone for Larimore North Dakota is currently Central Daylight Time CDT where the offset to Greenwich Mean Time GMT is -0500.

North Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

State Corporate Income Tax Rates And Brackets Tax Foundation

North Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

North Dakota Sales Tax Guide And Calculator 2022 Taxjar

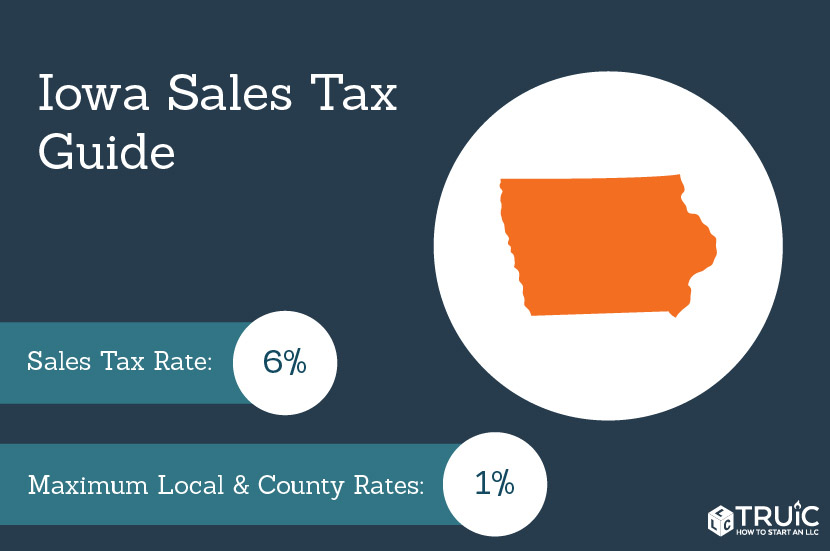

Iowa Sales Tax Small Business Guide Truic

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

North Dakota Sales Tax Guide And Calculator 2022 Taxjar

North Dakota Sales Tax Rates By City County 2022

Internet Sales Tax Definition Types And Examples Article

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

The Consumer S Guide To Sales Tax Taxjar Developers

State Corporate Income Tax Rates And Brackets Tax Foundation

North Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price